Datasheet 搜索 > Micro Commercial Components(美微科) > UMX1N-TP 数据手册 > UMX1N-TP 开发手册 1/2 页

¥ 1.763

UMX1N-TP 开发手册 - Micro Commercial Components(美微科)

制造商:

Micro Commercial Components(美微科)

封装:

SOT-363

Pictures:

3D模型

符号图

焊盘图

引脚图

产品图

UMX1N-TP数据手册

Page:

of 2 Go

若手册格式错乱,请下载阅览PDF原文件

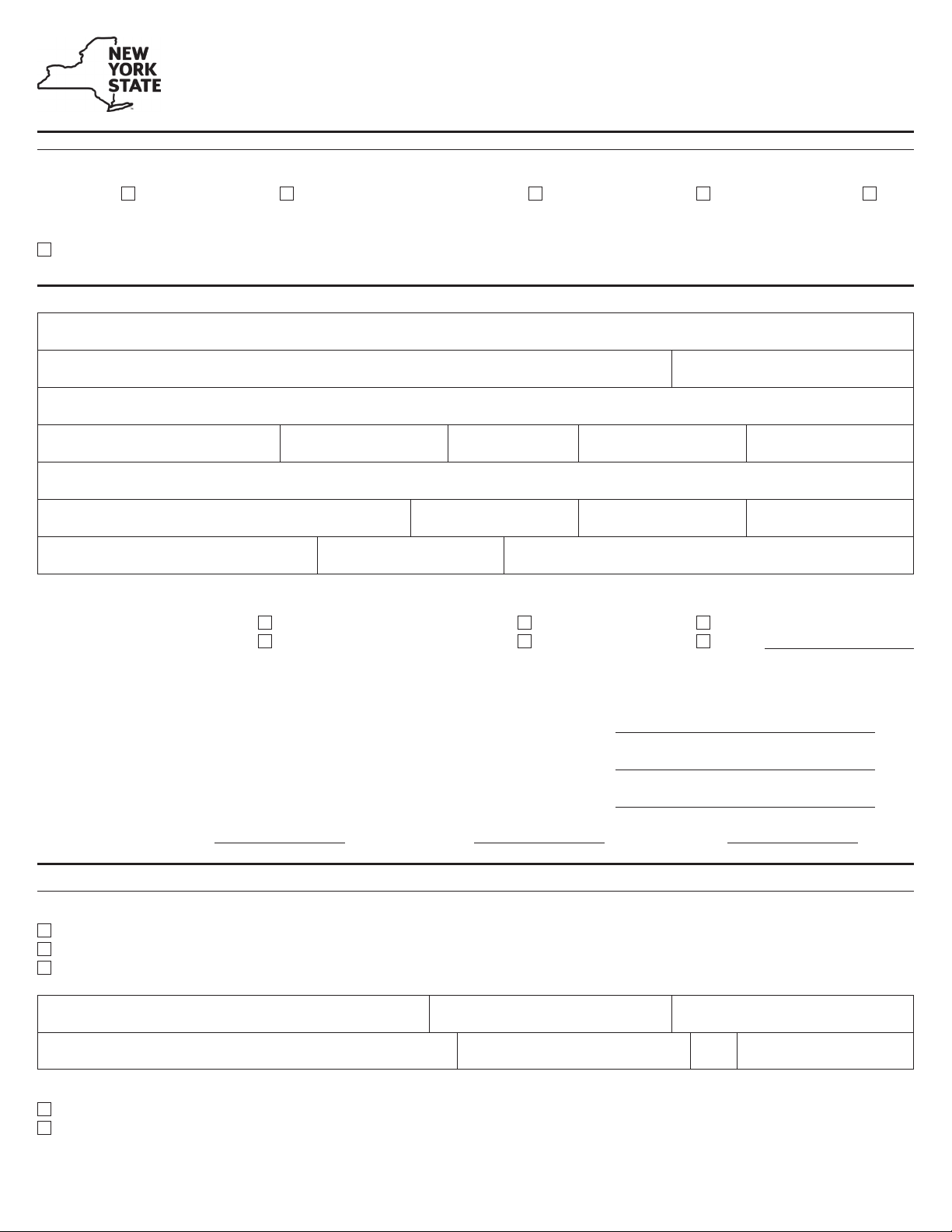

Department of Taxation and Finance

Application for Registration as a

Distributor of Alcoholic Beverages

Tax Law – Article 18

TP-215

(2/17)

I am applying for registration as a distributor of alcoholic beverages for the following (mark an X in the box for all that apply):

Liquor Beer Direct wine shipper Wine Cider

Read Form TP-215-I, Instructions for Form TP-215, before completing this form. Answer all questions. Attach additional sheets as necessary.

Section A – Business identication (complete all applicable elds; see instructions)

Legal name

DBA or trade name

(if different from legal name above) Federal employer ID number (EIN)

Address of principal place of business

(number and street; not a PO box)

City U.S. state / Canadian province County ZIP / Postal code Country

Mailing address (if different from business address)

City U.S. state / Canadian province ZIP / Postal code Country

Business number Fax number E-mail address

( ) ( )

Type of organization (mark an X in one or more boxes):

Sole proprietorship (individual) ......... Partnership ................................... Corporation ..............

Limited liability partnership (LLP) ..... Limited liability company (LLC) ..... Other

......................... (specify)

Do you elect to le annually?

Yes – I am eligible, and I elect to le my tax return on an annual basis rather than on a monthly basis (see instructions).

Indicate the number of liters (or gallons if wine, cider, or beer) you expect to sell per month.

Liquor, alcohol, and distilled or rectied spirits:

Over 24% alcohol by volume

.................................................................................................. liters

Over 2% but not over 24% alcohol by volume ......................................................................... liters

½% but not over 2% alcohol by volume .................................................................................. liters

Wine

(include sparkling and still) gallons Cider gallons Beer gallons

Are you registered as a New York State sales tax vendor?

Yes

No – You must apply and receive your NYS Certicate of Authority before this application will be approved for registration. You may apply online

by using the New York Business Express at www.businessexpress.ny.gov.

Do you have a State Liquor Authority (SLA) license?

Yes – Enter below the exact name, address, and identication number that appear on your New York State license.

No – You must be licensed by the SLA before your application can be approved (see instructions).

Application pending (see instructions).

Name License type License number

Number and street City State ZIP code

Section B – Other requirements

器件 Datasheet 文档搜索

AiEMA 数据库涵盖高达 72,405,303 个元件的数据手册,每天更新 5,000 多个 PDF 文件